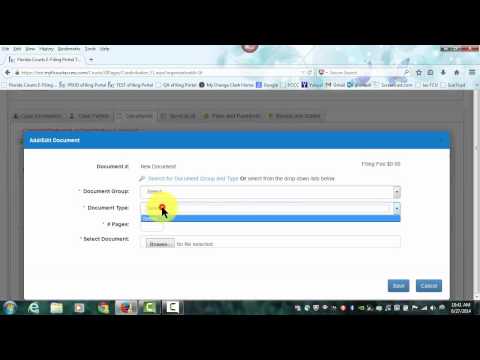

Here are the corrected sentences: 1. Welcome to the Florida courts efiling portal. This training is for self-represented litigants. 2. To access the Florida courts efiling portal, type "WWE al court access com" in your browser's address bar. This will take you to the portal. 3. Once you are on the portal, click on the "e filing portal" link in the menu bar, or click on the "file now" button. This will take you to the Welcome page for the Florida Court Z filing portal. 4. Use the username and password you requested to login to the portal. 5. After logging in, you will see the Florida courts efiling map. Select the county where you wish to submit your new case. 6. You can select the county either by clicking on the county in the map, or by choosing it from the drop-down menu. Let's select "Duval County" by selecting Duval in the Florida map. 7. Next, click on "new case" and "file now" from the drop-down menu. 8. From the drop-down menu, select the division where you are submitting your new case. Let's choose "county civil" as our case type. 9. For the subtype, choose the option that best applies from the drop-down menu. In this case, we will choose "Auto Negligence $2,500 to $5,000." 10. The amount of your filing fee is shown on the right. This is based on Florida Statutes, and only your statutory filing fees apply. 11. There is no fee to file documents electronically, but there is a fee to file a new case. 12. If your case complies with the rules regarding emergency filing, you may mark it as an emergency filing. You may also add a matter number if you choose to do so. Then, click on "next." 13. On the case parties page, you need to add your plaintiffs and defendants. To do this,...

Award-winning PDF software

Florida eviction summons Form: What You Should Know

Get Hip Direct Deposit Form with US Legal Files PDF File You'll receive a copy to print, download and review. Read this article to learn how to download and complete the US Legal Forms. Then proceed with HIP-DIRECT DEPOSIT. For the US Legal Forms and other information about Form 5022, please read this article or visit this site. You'll get your own copy of the HIP Direct Deposit Form as soon as one arrives. It's a federal law — you should check federal laws before filing with the state for HIP-DIRECT DEPOSIT. Hip Direct Deposit “Form 5022: Texas — Form 5022 Form 5022 “HIP Direct Deposit” — US Legal Forms US Legal Forms for Texas HIP Direct Deposit Form 5022 “HIP Direct Deposit”– US Legal Forms (Filing Form 2) Texas Legal Forms for HIP Direct Deposit Form 5022 “HIP Direct Deposit”– US Legal Forms (Filing Form 2) HIP Direct Deposit (Federal Office of Personnel Management & Texas Health and Human Services) The Federal Health Care Program, or HIP, Direct Deposit provides for prompt payment of premiums by the insured to their health insurance company. This form is provided by the federal Office of Personnel Management. There are many similarities between Federal and Texas law. See HIP-DIRECT DEPOSIT by the Federal government. HIP-DIRECT DEPOSIT by the Federal government The Federal and Texas HIP Direct Deposits are very similar in structure and procedure and are both designed for the same purpose — to allow employers to make monthly payroll payments to employees, their dependents and, in the case of self-insured policies, to their respective HMO's. For both, employers should be aware of the requirements set forth in Federal and Texas law. The Texas Health and Human Services Department is the federal entity that oversees the Texas HIP Direct Deposits. For additional information, visit the Federal law on HIP-Direct Deposits. If you have any questions, you should contact the Office of HIP Client Services at. See Form 5022: Texas HIP Personal Information Payment System.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3-Day Notice Florida, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3-Day Notice Florida online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3-Day Notice Florida by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3-Day Notice Florida from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Florida eviction summons